Thisis posted to the Unearned Revenue T-account on the debit side (leftside). You will notice there is already a credit balance in thisaccount from the January 9 customer payment. The $600 debit issubtracted from the $4,000 credit to get a final balance of $3,400(credit). This isposted to the Service Revenue T-account on the credit side (rightside). You will notice there is already a credit balance in thisaccount from other revenue transactions in January.

Mistake: Incorrect Accounting Entries

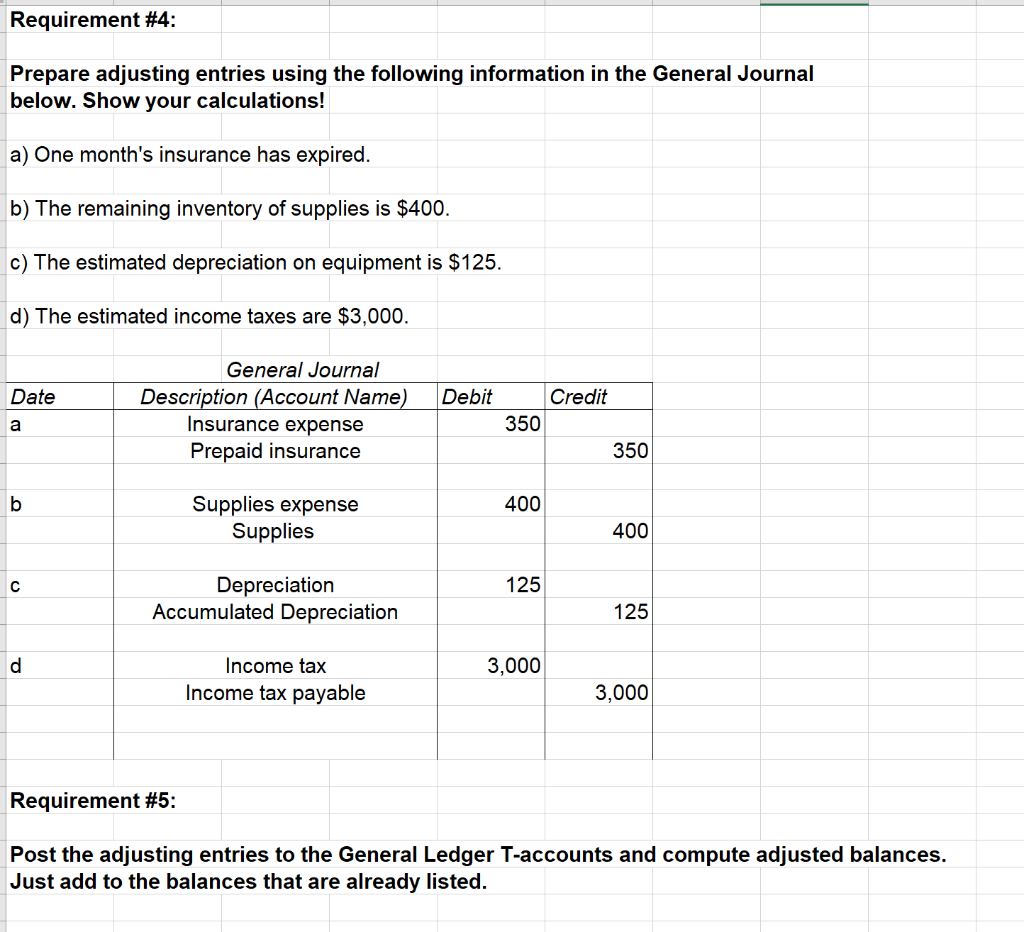

Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles. These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period. Depreciation expense is the allocation of the cost of a long-term asset over its useful life. To record depreciation expense, an accountant would debit an expense account and credit an accumulated depreciation account.

Unearned Revenues

For example, let’s assume that in December you bill a client for $1000 worth of service. They then pay you in January or February – after the previous accounting period has finished. A related account is Insurance Expense, which appears on the income statement.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

In other words, accrual-based accounting just doesn’t function without adjusting entries. To understand how to make adjusting entries, let’s first review some useful accounting terms that relate directly to this topic. One of the most common mistakes is making incorrect accounting entries. This can happen due to a lack of attention to detail or a misunderstanding of accounting principles. To avoid this mistake, it is essential to double-check all entries and ensure that they are accurate.

A lag in recording transactions can also lead to incorrect financial statements. This can happen when transactions are not recorded in a timely manner or when are adjusting entries prepared when they are recorded incorrectly. To avoid this mistake, it is important to record transactions as soon as possible and ensure that they are accurate.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Interest Revenue increases (credit) for $1,250 because interest was earned in the three-month period but had been previously unrecorded.

- When the company provides the printing services for thecustomer, the customer will not send the company a reminder thatrevenue has now been earned.

- Income Tax Expense increases (debit) and Income Tax Payable increases (credit) for $9,000.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. Adjusting entries are made at the end of an accounting period after a trial balance is prepared to adjust the revenues and expenses for the period in which they occurred.

Accumulated depreciation is the total amount of depreciation recorded for a long-term asset since it was acquired. To record accumulated depreciation, an adjusting entry is made to increase the accumulated depreciation account and decrease the corresponding asset account. Depreciation is the allocation of the cost of a long-term asset over its useful life. To record depreciation, an adjusting entry is made to decrease the asset account and increase the corresponding depreciation expense account.

If so, this amount will be recorded as revenue in the current period. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Using the tableprovided, for each entry write down the income statement accountand balance sheet account used in the adjusting entry in theappropriate column. Recall that unearned revenue represents a customer’s advancedpayment for a product or service that has yet to be provided by thecompany. Since the company has not yet provided the product orservice, it cannot recognize the customer’s payment as revenue.