This is another simple calculation that shows dividend payouts as a percentage of a company’s total profits. To arrive at this number, divide the total amount of dividends paid in a period by net income from the same period. Sometimes you know the dividend yield immediately, making the task easier.

Dividend Yield vs. Payout Ratio: What is the Difference?

Dividends are the slice of a company’s earnings that are distributed to stockholders. These payments, usually paid on a quarterly basis, are a form of reward for shareholders who are the company’s owners. The amount of dividends paid out is decided upon by the company’s board of directors and may require shareholder approval. Dividends can significantly impact an investor’s overall return by providing a steady income stream and potentially boosting the market price of the stock.

Total return

However, the tax treatment of dividends can vary depending on a variety of factors, including the type of account in which the dividend-paying stocks are held and the investor’s personal tax situation. The trailing dividend yield is done in reverse by taking the last dividend annualized divided by the current stock price. Other factors to consider include the company’s debt load, credit rating, and the cash it keeps on hand to manage unexpected shocks. And as with every equity investment, it’s important to look at the company’s competitive position in its sector, the growth prospects of that sector as a whole, and how it fits into an investor’s overall plan. Those factors will ultimately determine the company’s ability to continue paying its dividend.

Dividend Yield Calculator

Investors can calculate the annual dividend of a given company by looking at its annual report, or its quarterly report, finding the dividend payout per quarter, and multiplying that number by four. For a stock with fluctuating dividend payments, it may make sense to take the four most recent quarterly dividends to arrive at the trailing annual dividend. This is because the number of profitable growth opportunities for them is limited. It will generate more value for the shareholders if they pay out their net income as dividends.

- It can be assumed that every dollar a company is paying in dividends to its shareholders is a dollar that the company is not reinvesting to grow and generate more capital gains.

- Company A’s dividend yield is 4% while Company B’s yield is only 2%, meaning Company A could be a better bet for an income investor.

- Dividend yield can help assess a company’s valuation relative to its peers, but there are other factors to consider when researching stocks that pay out dividends.

- Dividend yield fell out of favor somewhat during the 1990s because of an increasing emphasis on price appreciation over dividends as the main form of return on investments.

A monthly dividend of $0.255 times 12 equals an annualized dividend of $3.07 (rounded). That $3.07 dividend divided by a share price of $60 equals a dividend yield of 5%. If you’re looking to collect dividends as often as possible, stocks that pay monthly may be ideal. Most (although not all) monthly payers are REITs, or real estate investment trusts. This category of companies benefits from some tax advantages that allow them — actually, require them — to pay above-average dividends. Investors must invest in a systematic manner to accumulate dividend-yielding stocks.

What are dividends and how do dividend yields work?

• For many investors, the primary reason to invest in dividend stocks is for income. So when using dividend yield as a way to evaluate income, it’s important to be aware of company fundamentals that provide assurance as to company stability and consistency of the dividend payout. Dividend yield, on the other hand, refers to a stock’s annual dividend payments divided by the stock’s current price, and expressed as a percentage.

Suppose Company A’s stock is trading at $20 and pays annual dividends of $1 per share to its shareholders. Suppose that Company B’s stock is trading at $40 and also pays an annual dividend of $1 per share. If a company returns a big percentage of its profits in dividends — one common threshold is 80% — some investors may view that as a warning sign about the long-term viability of those payouts. If you’re more interested in long-term growth than shorter-term income from your investments, dividends may not be so significant to you.

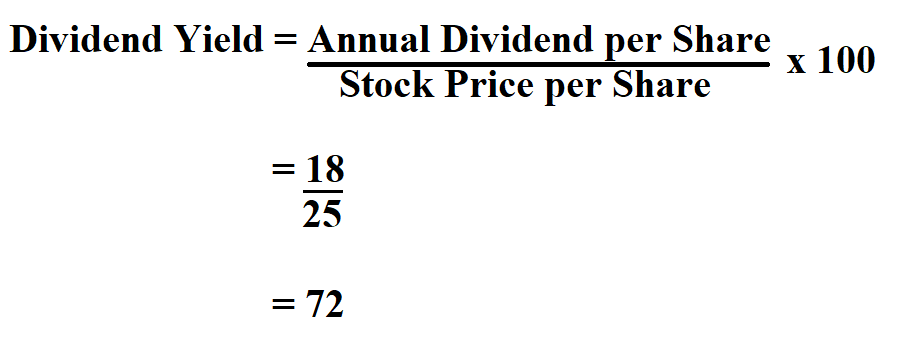

As there is no accurate capital gains information available, this yield on dividend acts as a potential return on investment for a given stock. Understanding dividend yield helps investors compare the attractiveness of different stocks and can also be an indicator of a company’s financial health. The dividend yield definition says it’s the ratio of the annual dividends paid by a company over its current stock price.

For example, in the image below you can see the dividend yield listed for Duke Energy. There is a group of S&P 500 stocks called Dividend Aristocrats, which kennedy introduces bill expanding louisiana disaster victims have increased the dividends they pay for at least 25 consecutive years. Every year the list changes, as companies raise and lower their dividends.